COVID19 Market Update

I hope this article finds you healthy and safe. Indications are that a more prolonged time of social distancing and general disruption of normal business patterns will be required to help slow and ultimately end the spread of the COVID-19. These measures have impacted markets all over the world, ours is no exception. Real estate activity along the Gulf Coast continues, albeit at a slower pace.

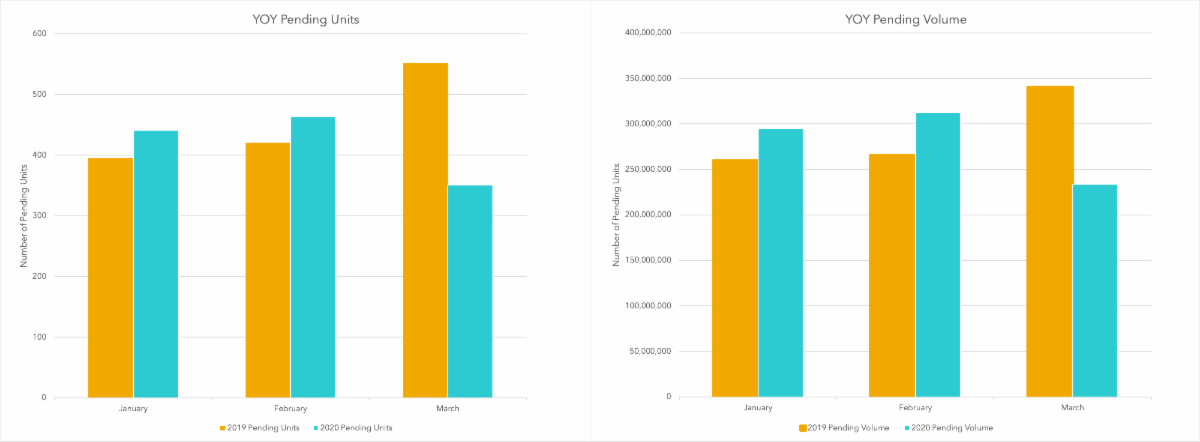

These charts compare total YTD pending contracts represented in both number of units and dollar volume compared to the same period last year. The first two months of this year started strong with number of units up 10.9% and volume up 15.6%. Impacted by COVID-19, March is down 36.4% and 31.3% in units and volume, respectivley. Pending contacts are a more accurate depiction of real time activity as closings typically occur 30-45 days after the contract date.

It is no surpise that the pace of new contracts is slower. Many segments of business are on hold and certain travel restrictions exist. The logical next question is, how will the market react once life returns to normal? The answer is simple, who knows…nobody can predict the future. However, it can be helpful to look at historical data to see how our market has reacted to past major events. When doing so, it is important to review what conditions existed in the market prior to these major events and how the markets reacted to those events. We looked at two recent times, 1) 2007-2010 (the great recession coupled with the housing bubble followed by the BP Oil Spill) and 2) 2001 (The DotCom market collapse followed by 9/11). Specifically, we looked at Inventory Levels, Price Appreciation Trends, The Mortgage Credit Availability Index and Total Cash Transactions. The following data covers the 30A, Destin/Miramar Beach and Niceville markets.

Months of Inventory on Market from January 1995 - March 2020

(Blue Line is 30A (South Walton County), Green Line is Destin/Miramar Beach and Orange Line is Niceville)

The above data comes from FlexMLS and shows a substantially oversupplied market stemming from the 2007/2008 downturn (and Hurricane Katrina) vs a healthy or arguably under supplied market in 2019/2020.

Annual Price Appreciation January 1995 - March 2020

(Blue Line is 30A (South Walton County), Green Line is Destin/Miramar Beach and Orange Line is Niceville)

The above data, from FlexMLS, shows an unsustainable increase in pricing leading into 2007/2008 (bubble) vs the steady, stable growth over the last 6-7 years.

Mortgage Credit Availability Index and Percentage of Cash Transactions

The above chart from the Mortgage Bankers Association, shows the availability of mortgages on a national level. The lower the index, the harder it is to qualify for a mortgage. The index has remained extremely low the last 10+ years. This indicates that buyers who do get mortgages face tougher, more stringent underwriting requirements and are thereby, more qualified, unlike like leading up to the Great Recession.

The above chart shows, by market, the percentage of transactions that include mortgages and indicates that Destin and 30A are still showing a high level of all cash buyers (~30-35%) while Niceville remains close to historical norms.

In summary, the current market with healthy inventory levels, stable growth, tighter lending standards and higher/normal percentage of cash buyers, indicate the market is in far better condition than it was going into 2007-2009.

Current stock market instability is being caused by an outside event (the coronavirus) with no connection to the housing industry. Many experts are saying the current situation is much more reminiscent of the challenges faced when the dot.com crash was immediately followed by 9/11. As an example, David Rosenberg, Chief Economist with Gluskin Sheff + Associates Inc., recently explained:

“What 9/11 has in common with what is happening today is that this shock has also generated fear, angst and anxiety among the general public. People avoided crowds then as they believed another terrorist attack was coming and are acting the same today to avoid getting sick. The same parts of the economy are under pressure ─ airlines, leisure, hospitality, restaurants, entertainment ─ consumer discretionary services in general.”

The lingering psychological effects of 9/11 on the consumer led many to look for “safe havens” to invest their money and spend their time. Many people avoided air travel and larger populated areas for years after. This resulted in drive-to destinations and markets with strong regional consumer bases experiencing a spike in demand.

The below chart shows closings (light blue) and Average PSF for the combined 30A, Destin/Miramar Beach and Niceville markets from 2000-2004.

The underlying drive-to fundamentals and strong regional consumer base have contributed to the Gulf Coast showing great resilience and prosperity following past major events.

Note: All market data was obtained from ECAR via FlexMLS.

Call me if you have any other questions about the current market or when you're ready to buy.

- Created on .

- Hits: 5977